Staying the course, and not being distracted by short-term market events, is just as important in retirement as it is at any other time.

Retiring from work shouldn’t necessarily equate to retiring from managing your investment portfolio.

In fact, taking an active role in your investments during retirement will ensure you have the best chance of protecting and growing your capital over time.

Australian Bureau of Statistics data shows average life expectancies in Australia are now at a record high and among the highest in the world.

According to the latest ABS statistics, the average male life expectancy at birth had reached 81.2 years in 2018-2020, increasing from 80.9 in 2017-2019.

The average female life expectancy had also increased to 85.3 years, from 85 years.

From a financial perspective, a key question for most of us is whether we’ll have enough money to last all the way through our retirement years?

In fact, it’s such a common question that in financial circles the prospect of running out of retirement money before death is officially known as “longevity risk”.

Reducing financial longevity risk is a challenge.

For many retirees, low-risk assets such as cash and government-backed bonds are often seen as the safest ways of protecting capital over the long term.

Yet, depending on your broad retirement goals and tolerance for risk, putting all your eggs into low-risk asset classes may expose you to investment hazards over the longer term.

What you may see as a safe investment strategy today could easily become the opposite over time.

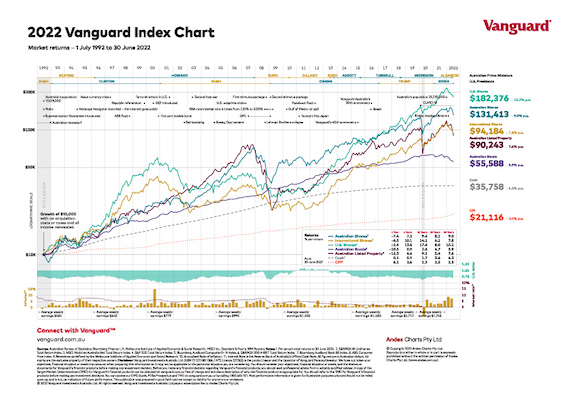

The index chart below puts that all into context, because it shows exactly how different asset classes have performed over the last 30 years.

Cash is arguably the safest investment there is, especially in Australia where the federal government guarantees the security of all deposits with authorised deposit-taking institutions up to $250,000 per accountholder.

If you’d retired back in 1992 and had invested all your savings into cash that year, you could have earned a return of 9.0 per cent.

But cash returned just 0.1 per cent in 2021-22, and since 1992 it has delivered an average annual return of 4.3 per cent – the lowest return of all asset classes.

Diversification pays off

This underscores the importance of having good asset diversification, even in retirement, to help preserve capital and generate longer term capital growth along with income.

You can see from the index chart that $10,000 invested into different assets in 1992 would have produced very different cumulative returns, ranging from $35,758 (cash) through to $182,376 (U.S. shares).

The Australian share market has produced an average annual return of 9.0 per cent since 1992.

The dollar figures in the index chart are calculated on the basis that all of the distributions over the 30 years, including interest and dividends, had been reinvested back into the same assets to maximise the effect of compounding returns.

Asset classes perform differently from year to year, but the historical data going back for decades shows that despite inevitable short-term price dips, over the long term you can expect each asset class will deliver growth.

Since 1992 there have only been a handful of occasions when the same asset class has been best-performing in consecutive years. So, it never makes sense to chase after last year’s returns.

For example, in 2018-19 Australian listed property was the best-performing asset class, returning 19.3 per cent.

Just a year later the same segment showed a negative return of 21.3 per cent (primarily due to the impact of COVID-19) – a reversal of 40.6 per cent.

That’s where investing across a range of asset classes, including during your pension drawdown phase, will help smooth out poorer returns from other asset classes from year to year.

Avoid knee-jerk decisions

Short-term periods of market volatility can be unsettling.

As global markets fell sharply during the early part of 2020, some retirees hastily chose to divest their equity positions in favour of the relative safety of cash.

In doing so, however, they effectively crystalised their equity losses and may have totally missed the strong rebound in global equity markets that quickly followed.

It’s a powerful example of why time in the market will invariably win over trying to time the market when it comes to achieving investment success.

Staying the course, and not being distracted by short-term market events, is just as important in retirement as it is at any other time.

It’s also important to focus on the things you can control.

That includes reviewing your spending regularly and making sure you’re invested in products that have low management costs.

The lower your investment costs the more money you have to enjoy your retirement.

The best approach to building an investment portfolio that will help protect your retirement capital is to apportion funds across different asset types, such as shares, bonds, property, and cash.

Having a well-diversified portfolio will offset the risks of being too exposed to one asset class.

If you would like to discuss your retirement strategy or would like to review your investment portfolio, call us on Phone 08 9200 2795.

Source: Vanguard

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2022 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.